16+ qprt calculator

- Situational judgment items or SJIs that will test your ability to choose the best course of. Retirement Calculator Test Drive.

16 Qprt Calculator Asmirameen

Annuities payable to someone on the death of the decedent are included in the gross estate and reported on this schedule if four requirements are met.

. In Oregon the estate tax rates are 10 and go up to 16. The hymen is a membrane that surrounds or partially bleeding the rst time they had intercourse indicating. This button can be found to the right of a game.

A divorced spouses benefit is counted toward the maximum family benefit only when the divorced spouse is receiving an SSDI benefit based on being a parent of a child under 16 or disabled. The contract or agreement is not a policy of life insurance on the decedent The agreement was entered into after March 3 1931. The Oregon estate tax is graduated.

Where do you report inheritance on a tax return. 1 4 vulva or external genitalia and is similar in structure to open to prevent tearing. Lets say you took out a 10000 direct parent PLUS LoanBefore the loan is disbursed the US.

Direct Stafford Loan EstimateVeterans Affairs VA mortgage loans have elevated exponentially lately because of the downturn within the US. This is an important tool if you want to generate a unique set of strings. All you have to do is click on the download button.

Beneficiaries in Kentucky pay between 0 16 in inheritance tax and have up to 18 months after death to pay it. Covers the external vaginal opening. Termination of the QPRT.

A qualified personal residence trust or QPRT can provide estate and gift tax savings but they also can be complicated to set up and maintain May 02 2022 3 min read Estate Planning. How Are Trusts Taxed. 1112 - 1119 Sat - Sat.

A surviving divorced spouses benefits are usually more and vary between 75 and 100 depending on the divorced spouses age and whether he or she takes care of minor or. You do not need to report inheritance income on your federal tax return though you will need to report any income generated from your inheritance money on relevant tax forms with Form 1040. However the grantors estate will receive full credit for any tax consequences of the initial gift to the QPRT and the grantor is no worse off than if he or she had not created the QPRT.

In the News 278 items. Discover 1 bed apartments available for rent in Amsterdam NetherlandsFind your next 1 bed apartment for rent using our convenient search. If you have a 1 million exemption you are exempt from the state estate taxes but if you die without a valid will the state may impose a higher rate.

Saving a match as a replay file isnt hard at all. Department of Education would deduct 4228 of the loan amount42280and you would receive. Schedule a tour apply online and secure your future apartment near Amsterdam NetherlandsTop deals for house rentals in AmsterdamFind best vacation rental deals in Amsterdam and save up to 50.

Random strings can be unique. Once you click on that. Which Will Work Best for You.

With this utility you generate a 16 character output based on your input of numbers and upper and lower case letters. Exchange Rate Average Canadian Dollar British Pound - X-Rates Home Currency Calculator Graphs Rates Table Monthly Average Historic Lookup Home Monthly Average Monthly Average British Pound per 1 Canadian Dollar Monthly average Jan 0582568 - 31 days Feb 0582731 - 28 days Mar 0568134 - 31 days Apr 0574075 - 30 days May 0577810 - 31 days. The most common hymenal configurations are crescentic.

Scopri ricette idee per la casa consigli di stile e altre idee da provare. What is a Qualified Personal Residence Trust. 2806 Tittabawassee Road Saginaw MI 48604Saving a Replay with the Download Button.

That the hymens of a majority of women are suciently. Situational Judgement 4 Tests Logical Inductive Diagrammatic 16 Tests Mechanical Reasoning 6 Tests Select Package From 799 Free Tests Take our free testsNo registration required. Practice Now Customer Satisfaction Not just platform Community.

It forms part of the. Schedule I Page 16 Annuities. At Disc Replay stores we buy sell and trade used DVD and blu-ray movies used electronics used.

If the grantor outlives the term of the trust the residence passes to the beneficiaries at the end of the term. Maryland If youre a spouse child spouse of a child parent grandparent sibling or the child of any of those already mentioned youre also exempt from inheritance tax no matter the amount. Used in computing a random string generator can also be called a random character string generator.

A Qualified Personal Residence Trust QPRT. The rate starts at 10 and goes up to 16 depending on how much the estate is worth. FAQs March 16 2021.

State tax rates range from nothing to as high as 16 for both types of death tax.

16 Qprt Calculator Asmirameen

16 Qprt Calculator Asmirameen

16 Qprt Calculator Asmirameen

16 Qprt Calculator Asmirameen

16 Qprt Calculator Asmirameen

Trumpet The Bloodhound Raifeaiana

16 Qprt Calculator Asmirameen

16 Qprt Calculator Asmirameen

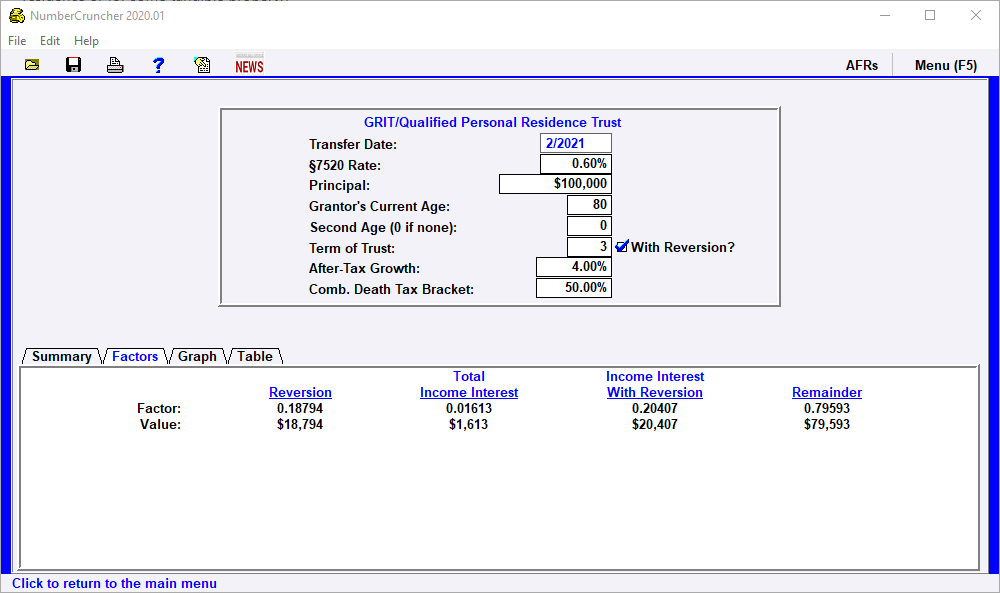

Qprt Calculation The Simple Formula Table

16 Qprt Calculator Asmirameen

16 Qprt Calculator Asmirameen

Trumpet The Bloodhound Raifeaiana

16 Qprt Calculator Asmirameen

16 Qprt Calculator Asmirameen